Historic New Hampshire City Is America’s Hottest Housing Market as Homebuyers Flock to Tax-Free Haven

Realtor.com; Getty Images(5)

A New Hampshire city gets bragging rights as people are flocking there for its convenience, character, and low-cost living.

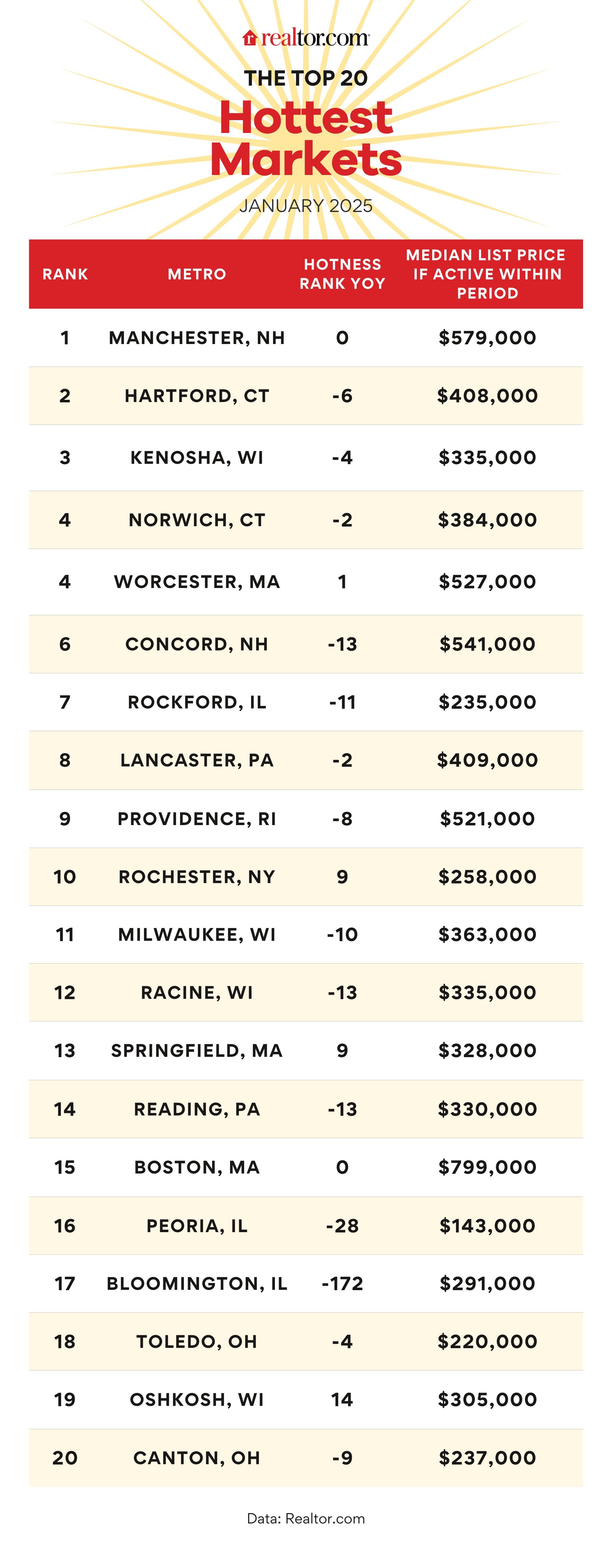

Manchester, NH, is No. 1 among America’s Hottest Housing Markets, according to the Realtor.com® January report. It’s back on top after being sidelined by Springfield, MA, in November and Rockport, IL, in December.

“Manchester’s hotness means that high demand is met with low inventory as buyers claim available homes,” says Realtor.com® senior economic research analyst Hannah Jones. “The ongoing demand in the area has prevented inventory from recovering, keeping attention-pre-property high and market pace snappy.”

The median list price in Manchester was $579,000 in January, up nearly 4% from the month before; but that did nothing to cool the demand, with properties lingering unsold on the market for just 46 days compared with the national median of 73 days.

Listings in Manchester drew close to four times as many viewers on Realtor.com last month as was typical in the U.S. during the same period, signaling an elevated level of buyer interest.

(Realtor.com)

Located just 55 miles from Boston, Manchester has long been a buyer favorite, offering a good school system, a thriving local economy, and plenty of outdoor activities.

Another major selling point for living in the Granite State with the motto “Live Free or Die”: Residents do not have to pay sales or income taxes, and its poverty level was the lowest in the U.S., at 7.2% in 2023, according to the U.S. Census Bureau.

Coming right behind Manchester at No. 2 on the list, Hartford, CT, distinguished itself in January by boasting more than four times the listing views per property as the national median, the most of any of the 20 hottest markets.

The Northeast and Midwest still reign supreme

For the 16th straight month, the Northeast and the Midwest were the only two U.S. regions represented on January’s Hottest Housing Markets list.

“The Midwest and Northeast have reigned supreme as homes to most of the country’s hottest markets since mid-2022, when mortgage rates picked up steam,” says Jones.

All but four markets on the January list were also represented on December’s top 20 list. The quartet of new arrivals included Concord, NH; Rochester, NY; Boston; and Bloomington, IL.

Notably, January marked Bloomington’s first foray into the top 20 list from within the top 50 markets.

The hottest markets see higher demand and prices

In January, home prices slid 2.2% year over year nationally. However, among the hottest markets, prices inched up 1.5%.

Meanwhile, demand in the hottest markets, as measured by views per property on Realtor.com, was nearly three times the national level.

In Manchester, the median list price jumped nearly 2.5% year over year. Overall, half of the 20 hottest markets saw an uptick in median list prices, driven by heightened demand.

“High demand and scarce inventory conditions drive views per property higher, upping the competition for homes in the hottest markets, and leading to snappier home sales,” according to Jones.

Homes in the hottest markets sold about a day slower than last year but spent three weeks less time on the market than typical nationally.

Home inventory remains a challenge

Looking at inventory, all but three of the hottest markets saw a more modest increase in active listings than the 24.6% year-over-year surge nationally.

On average, the 20 hottest markets saw home stock increase 12.7% in January compared with the same period last year.

While most of the hottest markets saw an improvement in inventory levels, on average there were half as many homes for sale in January in those metros compared with pre-pandemic levels, far outstripping the national decline of just under 25%.

“Housing affordability continues to be a challenge for home shoppers as home prices and mortgage rates refuse to budge significantly,” says Jones. “On the bright side, new construction continues to offer buyers attractive prices and welcomed incentives.”

Southern markets continue cooling

Four markets that ranked at the bottom of December’s 20 top list dropped out in January, including Springfield, IL; Akron, OH; Waterbury, CT; and Topeka, KS.

But the metros that experienced the most dramatic annual declines in popularity were mostly in the South and the West.

Spokane, WA, has fallen the furthest down the list in the span of a month, followed by Savannah, GA, and Rocky Mount, NC.

Large housing markets seeing improvement

The 40 largest markets in the U.S. on average cooled by seven spots in the hotness rank compared with last year, but they still drew 13.3% more views per listing than was typical in January.

Additionally, homes in those areas, which saw list prices shrink by 1.4%, spent nine fewer days on the market.

Philadelphia saw the biggest improvement in its hotness ranking among large cities compared with last year, climbing a whopping 57 spots to rank as the 62nd hottest market in January.

The City of Brotherly Love was joined on its upward trajectory by New York City and Kansas City, MO, which rose 53 and 44 spots, respectively, on the market hotness scale.

“Large, often high-priced, markets are starting to adjust to subdued buyer demand by lowering home prices and selling smaller, more affordable homes,” says Jones. “Some of the slowing price growth both nationally and in the largest markets is due to a change in the mix of inventory for sale.”

(Realtor.com)

Categories

Recent Posts

GET MORE INFORMATION